|

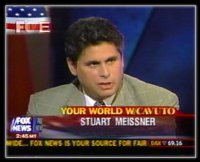

As a recent article in Financial Advisor IQ points out when a Registered Representative / Broker receives an 8210 Letter from FINRA requesting information and a signed statement, it would be wise to quickly call an experienced FINRA Attorney to assist in the initial response. Typically this follows a termination where the same Rep failed to contact an experienced FINRA Attorney to engage with the firm about what will be submitted in their U5 filing, which may have avoided the dreaded 8210 letter. The initial response to any 8210 letter sets the stage for what happens later. Too many reps call us, only after they responded on their own, to save money, only to learn that their response only did further damage, causing FINRA to further focus on them, by asking more questions and/or requesting that they come to FINRA for an on the record in intereview or an OTR. As a result not only is the time needed for an attorney to assist substantially lengthened, but the Rep is locked into a statement which is not helpful. These days there are many FINRA Enforcement action related to firm's meal reibursement programs such as the recent firing/suspension of a Morgan Stanley representative who did not have counsel), and/or a Fidelity broker who took advantage of a computer reimbursement programs allowance program. We have written about this issue before but it bears repeating as FINRA has been on war path with regard to such issues. Such programs provide for the expenditure of certain meals which the rep abuses, and/or the reimbursement for the purchase of a laptop which the rep then returns, but keeps the funds. These matters involve serious charges which reflect upon honesty and theft and thus FINRA takes such allegations seriously. In theory, these matters can turn into criminal proseuctions, as FINRA and/or the firm involved can refer them to local prosecutors. Those that treat such investigations as minor are in for a rude awakening when FINRA later suspends or Bars them. Further, most representatives, being self represented or represented by inexperienced FINRA counsel who are not familiar with FINRA's rules, fail to realize that a suspension even if short can in effect be the same as a bar if the AWC alleges it was intentional. As a result, the represenative becomes statutorily disqualified from the industry, meaning any firm that employs them would need to implement signficant oversight over the rep such that it makes it impossible for a firm to afford to employ them and they cant find a job. In addition, any admissions can in theory be used for a criminal prosecution. I have handled hundreds of U5 negotiations/FINRA 8210 Letter responses to date, and I have found that it is rare to find a case where we did not assist altering the U5 language so that the language was less impactful on the rep and/or avoided a potential 8210 Letter* while still accurate as to the reason for the departure. We engage with the firm and question every word of the proposed language asking the firm to attempt to support their proposed langauge or otherwise encourage them to alter it so that it better reflects what they know or do not know. Further, upon being retained to respond to a FINRA 8210 letter we request that the client provide us with their proposed response to FINRA as the first step. We have yet to see a single proposed response which did not require substantial modification while keeping the response accurate. For example, many representatives provide too much information , which was not even requested, and in so doing make matters worse. As a result, as many of our former clients attest to, we often succeeded in avoiding many of the negative repriccussions that would have been career ending for our clients wihout our assistance*. If you wish to have a free confidential/privleged phone consultation on your issue please feel free to contact me if you have recently been terminated or recieved an 8210 letter. Stuart Meissner Esq. Managing Partner Meissner Associates 212-764-3100 Note: New York based Meissner Associates is a nationally recognized employment law firm focused on the unique employment issues within the securities industry which is overseen by FINRA. The firm also represents SEC whistleblowers before the SEC, investors and securities professionals before FINRA arbitration panels and securities professionals in enforcement proceedings, as well as institutional and retail investors worldwide in recovering improper investment losses and protecting the employment rights of employees in the securities industry in FINRA arbitration and AAA Arbitration. Managing member Stuart Meissner is a former Assistant District Attorney in Manhattan and Assistant New York State Attorney General in the Investor Protection and Financial Crimes Units. Call Meissner Associates, FINRA Attorneys Nationwide Representation for FINRA Arbitrations Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation. Attorney Advertising

0 Comments

It is more common than you might think: A promising broker who is doing well for themselves with their current employer is recruited to join another firm after being promised the world.

The broker leaves their job to join this new firm and is shocked to learn that the enticements were misleading and/or false. We are seeing more and more often just how common this technique is, in particular with Citizens Securities, a subsidiary of Citizens Bank, according to our clients. After having filed multiple claims with FINRA, we are showing Citizens Securities that our clients mean business. Read on to learn more about the false recruitment promises in question and how our firm obtained an unheard-of result for one broker who had only been employed with Citizens Securities for four and a half months before the lies forced him to take action. The Bait and Switch Citizens Investment Services and other financial companies have faced accusations of tempting otherwise-successful financial planners into leaving their current positions and coming to work for their institution by making promises that often include inheriting a large book of business, usually tens of millions of dollars in business, and promises that they would be working in well-established branches. Brokers would then be issued a promissory note as part of the recruitment deal, which is typically repaid over a period of five years. However, in some cases, once these stockbrokers would agree to be recruited, things took a turn for the worse, as is believed was the case with Frank Aiello and several other former Citizens Securities brokers. Meissner Associates vs. Citizens Securities Our firm is proud to have assisted wronged brokers in obtaining awards after allegedly having been taken advantage of by Citizens Securities and other financial planning institutions. In the case of Aiello, he states that Citizens Securities recruited him from PNC Bank by promising him a $30 million book of business and the ability to work in his current Pennsylvania branch. He was also issued a $220,000 promissory note. He contends that almost immediately, things took a turn for the worse when he was not only forced to sign a backdated document stating he had never been made these promises, but he was not given the promised book of business and was sent to work in an entirely different branch. Aiello tried to make the best of a bad situation but left Citizens Securities just four months after being recruited, which meant his promissory note was due in full. After making a repayment offer of $150,000 that was ultimately rejected, he states that he began receiving threats that his broker license would be taken away by Citizens Securities. Concerned for his future, Aiello began working with our team at Meissner Associates, and after we did our due diligence and obtained damaging evidence against Citizens that we believe showed their blatant disregard for the truth, Aiello was issued an unheard-of award of nearly $1.7 million. We have also initiated claims for other wronged Citizens Securities brokers, including Wendy Morasco and several others who were allegedly made nearly identical promises by Citizens Securities only to find them to be lies. Meet with an Experienced FINRA Employment Dispute Lawyer If you are a stockbroker who was recruited based on false or misleading promises and are interested in holding the brokerage firm to account, reach out to a highly trained FINRA employment dispute lawyer at Meissner Associates. We provide free consultations to those like you who have been wronged by financial planning institutions. To take advantage of this opportunity, you can fill out the confidential contact form on the right side of this page or give our firm a call at 212-764-3100. |

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed