|

In August of 2021 FINRA fined and suspended for one month Former Registered Rep Giordan Marc Zaro who had worked Merrill Lynch. It would appear from the rendition of facts that Mr. Zaro was terminated by his employer Merrill Lynch for sending "confidential and proprietary information to his personal email address." It would appear that as a result of such termination, which appeared to have been done before the Rep could leave on his own, Merrill had filed a U5 reflecting such action which presumably was for the purpose to solicit his clients after he arrived at his new firm. It would appear that the U5 termination filing then triggered a FINRA Enforcement investigation which led to the suspension and fine, accomplishing a lot more for Merrill than they could have accomplished without triggering a FINRA Enforcement Investigation, tarnishing the Rep's entire career. Zaro joined the financial services industry in January 2017 with AXA Advisors and left the the same year to join Merrill in February 2018. Since his discharge from Merrill, Zaro registered with Emerson Equity in March 2020, according to BrokerCheck. He moved to Invicta Capital in January of 2021, but he has since departed such firm and has not registered with another firm..

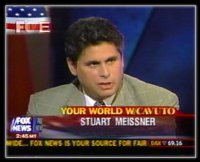

This series of events should be a wake-up call for any Rep thinking of departing their firm and what not to do in planning for such departure. Taking/transferring files out of the office without authorization to do so, even if temporarily, is seen as theft and a violation of FINRA's Code of Conduct. Departing employees should consult with a competent FINRA Attorney when changing firms so as to avoid mistakes such as this which have long term consequences. I have advised hundreds of Registered Reps in the transition process of changing firms, so as to avoid all complications, arbitrations, and regulatory issues and to ensure a smooth transition. If you are transitioning from one firm to another contact us for a free phone consultation at 212-764-3100. Stuart D. Meissner Esq.

0 Comments

More FINRA Enforcement Actions Re Inaccurate Meal Expense ReportsOnce again as reported in this Blog back in 2018 FINRA is continuing to crack down on Reps who file inaccurate firm expense accounts such as food expenses. This past year we have had another example of a Morgan Stanley Rep in the business for 34 years who allegedly filed false expense reports for over five years. Rep Kerry Moy agreed to a two month suspension and a $5000 fine to settle FINRA charges, this is after having been fired by Morgan Stanley. Notably the Rep WAS NOT accused of theft in that the charges were legitmate, but the Rep apparently permitted his assistant to submit expense reports with random client names and prospect names rather than the actual names of those who attended each meal. Therefore, this case seems like it was an act of laziness on the part of the rep, but from the view of his employer, Morgan Stanley, and FINRA, the REP had continously knowingly filed false expense reports, when if he had simply kept careful records and provided the actual accurate names of the clients and prospects for which the meals were expended for there would have been no firing or FINRA action.

This matter highlights how an act of careless record keeping and disregard of the prohibition of submtting false reports to one's employer can have a catastrophic impact on one's career, not to mention the cost of having to defend a FINRA enforcement proceeding. This matter also highlights how FINRA often focuses on low hanging fruit in their investigations as these expense account abuse cases are typically easy for them to prove with the coopeartion of the firm which maintains the expense report submissions and the failure of a rep to provide backup for the purported charges when the firm investigates. We are often asked about what is the typical resolution to these types of cases. The reality is there is no "typical" outcome as they are all very fact dependent. How long did it go on for? Was it an issue of mistake rather than intentional wrongdoing? Does one have backup to show how such was a mistake? How much money is invovled? Etc. We attempt to evaluate all the facts of one's situation and place them in the best possible light starting with the initial response to the 8210 Letter from FINRA so as to attempt to convince FINRA to either not pursue the case or to ultimately issue a warning or a minimal sanctions, rather than a lenghty suspension or outright Bar. If you have a matter you wish to discuss, please contact me at 212-764-3100 for a free consultation. Stuart D. Meissner Esq. Recently FINRA has been taking actions against brokers who miscode production numbers so as to avoid crediting former reps who had retired and left their book of business to the new rep. While most may think that the worst case scenario would be that the retired broker may file an arbitration against them if they found out, it turns out that is the least of the concerns. As noted in the recent cases of former Morgan Stanley brokers who not only were discharged by Morgan Stanley even though such miscoding was at the encouragement of supervisors, FINRA then took enforcement action against the reps. Most recently in the matter of John Miller, who was fined $15,000 and suspended for 15 days for violating high standards of practice. Such deal apparently was only permitted because of the involvement of management in the miscoding, as otherwise he would have faced conversion (theft) charges and a likely Bar.

Once again this matter shows why it is important to retain a qualified experienced FINRA Attorney to represent you in any FINRA Enforcement investigation as it could mean the difference between working in the industry and not. |

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed