|

Recently FINRA has been taking actions against brokers who miscode production numbers so as to avoid crediting former reps who had retired and left their book of business to the new rep. While most may think that the worst case scenario would be that the retired broker may file an arbitration against them if they found out, it turns out that is the least of the concerns. As noted in the recent cases of former Morgan Stanley brokers who not only were discharged by Morgan Stanley even though such miscoding was at the encouragement of supervisors, FINRA then took enforcement action against the reps. Most recently in the matter of John Miller, who was fined $15,000 and suspended for 15 days for violating high standards of practice. Such deal apparently was only permitted because of the involvement of management in the miscoding, as otherwise he would have faced conversion (theft) charges and a likely Bar.

Once again this matter shows why it is important to retain a qualified experienced FINRA Attorney to represent you in any FINRA Enforcement investigation as it could mean the difference between working in the industry and not.

0 Comments

Leave a Reply. |

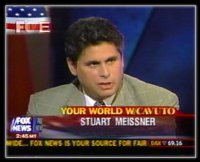

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed