Today's NY Law Journal details how a lawyer can completely undercut their client's employment claims if they disregard or are unaware of clauses within the employer's severance agreement which apparently included a non-disparagement clause. According to the Law Journal, Mr. Liddle chose to speak to the press about his clients' case, without any authorization to do so, and in so doing it is alleged it resulted in many of his clients losing their severance and bonus FINRA arbitration claims directly due to the violation of the non-disparagement clause in their agreements. Perhaps if he obtained his clients consent first (as we always do) in our opinion they could have at least reminded him of such clause, so as to have prevented such issue from happening just one month from the expiration of the clause. As noted in the article, the Appellate Division upheld the denial of a Motion to Dismiss the malpractice claim filed against Mr. Liddle and his firm. While there are many good reasons as a FINRA Attorney to speak to the press regarding an ongoing FINRA arbitration and other matters, one obviously wants to be careful to not only be truthful so as to avoid any defamation claim, but to also make sure that no contractual obligations are being violated by doing so, impacting the underlying case. A lawyer is generally an agent for their client, so that the client is thus responsible for what the lawyer says as Mr. Little's clients apparently learned the hard way. Malpractice Suit Over Lawyer's Newspaper Comments Proceeds Ben Bedell, New York Law JournalFebruary 10, 2016 A client's assertion that his attorney's "eagerness to get his name in the papers" caused him to lose a $1.3 million case states a claim for legal malpractice, a Manhattan appeals court ruled Thursday. Michael Barr, a securities industry executive, said Jeffrey Liddle, a founding partner of Liddle & Robinson, gave an interview to a newspaper that, according to Barr's former employer, breached Barr's agreement not to make any "disparaging statements" about the employer. A unanimous panel of the Appellate Division, First Department, upheld Justice Manuel Mendez's April 2015 denial of Liddle's motion to dismiss in an unsigned opinion. Barr was one of a group of 42 managers at Robertson Stephens, an investment bank that specialized in the software industry, who was laid off when the firm disbanded after the 2000 "dot-com bust." Liddle's firm was retained to prosecute the managers' severance and bonus claims in an arbitration proceeding. Barr's employment agreement included a clause which said his severance package would be revoked if, within six months of his termination, he made "any public statement that is adverse, inimical or otherwise materially detrimental to the interests" of Robertson Stevens or FleetBoston bank, which had bought Robertson and then tried to sell it just prior to its dissolution. A month before the clause would have expired, Liddle was quoted in The Wall Street Journal saying FleetBoston's "actions during the sale process drove down the value of the employees' stake in Robertson and damaged their reputations." FleetBoston said the quote violated the no-disparagement clause and denied Barr's claims. Read more: http://www.newyorklawjournal.com/printerfriendly/id=1202749141068#ixzz3zn3q5eCm

0 Comments

|

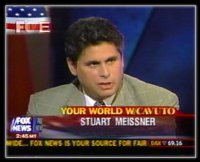

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed