|

It is more common than you might think: A promising broker who is doing well for themselves with their current employer is recruited to join another firm after being promised the world.

The broker leaves their job to join this new firm and is shocked to learn that the enticements were misleading and/or false. We are seeing more and more often just how common this technique is, in particular with Citizens Securities, a subsidiary of Citizens Bank, according to our clients. After having filed multiple claims with FINRA, we are showing Citizens Securities that our clients mean business. Read on to learn more about the false recruitment promises in question and how our firm obtained an unheard-of result for one broker who had only been employed with Citizens Securities for four and a half months before the lies forced him to take action. The Bait and Switch Citizens Investment Services and other financial companies have faced accusations of tempting otherwise-successful financial planners into leaving their current positions and coming to work for their institution by making promises that often include inheriting a large book of business, usually tens of millions of dollars in business, and promises that they would be working in well-established branches. Brokers would then be issued a promissory note as part of the recruitment deal, which is typically repaid over a period of five years. However, in some cases, once these stockbrokers would agree to be recruited, things took a turn for the worse, as is believed was the case with Frank Aiello and several other former Citizens Securities brokers. Meissner Associates vs. Citizens Securities Our firm is proud to have assisted wronged brokers in obtaining awards after allegedly having been taken advantage of by Citizens Securities and other financial planning institutions. In the case of Aiello, he states that Citizens Securities recruited him from PNC Bank by promising him a $30 million book of business and the ability to work in his current Pennsylvania branch. He was also issued a $220,000 promissory note. He contends that almost immediately, things took a turn for the worse when he was not only forced to sign a backdated document stating he had never been made these promises, but he was not given the promised book of business and was sent to work in an entirely different branch. Aiello tried to make the best of a bad situation but left Citizens Securities just four months after being recruited, which meant his promissory note was due in full. After making a repayment offer of $150,000 that was ultimately rejected, he states that he began receiving threats that his broker license would be taken away by Citizens Securities. Concerned for his future, Aiello began working with our team at Meissner Associates, and after we did our due diligence and obtained damaging evidence against Citizens that we believe showed their blatant disregard for the truth, Aiello was issued an unheard-of award of nearly $1.7 million. We have also initiated claims for other wronged Citizens Securities brokers, including Wendy Morasco and several others who were allegedly made nearly identical promises by Citizens Securities only to find them to be lies. Meet with an Experienced FINRA Employment Dispute Lawyer If you are a stockbroker who was recruited based on false or misleading promises and are interested in holding the brokerage firm to account, reach out to a highly trained FINRA employment dispute lawyer at Meissner Associates. We provide free consultations to those like you who have been wronged by financial planning institutions. To take advantage of this opportunity, you can fill out the confidential contact form on the right side of this page or give our firm a call at 212-764-3100.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

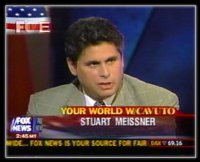

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed