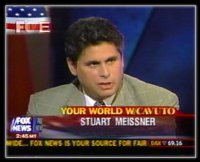

This week's WSJ stated that FINRA is on tear mandating that firms make sure that their reps are up to date on their disclosure filings with FINRA. Specifically representatives and firms must make sure all bankruptcies and financial disclosures such as judgements have been reported, as well as reportable criminal convictions, even if from college days. As a result of this FINRA proctology exam many reps are being reminded of long forgotten events they sooner would like to forget. However, apparently FINRA is very sloppy in its research mistaking reps for others who have similar or the same names and other errors. Depending on the type of disclosure representatives must remember that disclosure can have a drastic impact on a representatives ability to gain future employment, let alone clients, so it is prudent to make sure that only accurate disclosures are placed on their records. In 2010 FINRA issued a release which among other things allowed for : Brokers will be able to submit a written notice of the dispute to FINRA – FINRA will post the appropriate form on its website – with all available supporting documentation. If FINRA determines that the dispute is eligible for investigation, it will add a general notation to the broker's BrokerCheck report stating that the broker is disputing certain information in the report – and that notation will only be removed when FINRA has resolved the dispute. If its investigation shows the information is in fact inaccurate, FINRA will update, modify or remove that information as appropriate. As a result, ever since 2010 representatives have had two alternatives to correcting disclosures that appeared on BrokerCheck. As has always been the case, brokers could bring an arbitration claim in FINRA against the firm which made the filing and pursue an arbitration for "reformation" of their CRD ordering the firm to make a correction. However this process, the pursuit of which is controlled by the broker, can take many months and as a result can be expensive like all arbitrations. FINRA's alternative method provided for in 2010, allows for FINRA to investigate and make changes on their own, reducing the potential expense and allowing counsel for the broker, such as my firm, to represent reps for such submissions and follow-up based on an affordable flat fee basis. However, since the representative does not control the process, one is at the whim of FINRA Enforcement to investigate and make any changes. One can certainly try both routes; see if FINRA will make the changes first, limiting the expense, and if not, pursue arbitration, but either way the representative will need to weigh the likelihood of success (how accurate is the current information and can it be proven to be inaccurate) along with the expense, vs. leaving an incorrect black mark on one's record for their entire career. Stuart D. Meissner Esq. 212-764-3100

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed