|

In 2022 we have seen a variety of FINRA Enforcement investigations ranging from FINRA 8210 letters related to a Registered Representative's: 1) personal purchase of stock while posting on internet bullitin boards such as Reddit implicating FINRA Rule 2210 relating to Communications with the Public, and FINRA's Social Media Guidance within Regulatory Notice 10-06 Guidance on Blogs and Social Networking Web Sites. We successfully defended the rep in drafting a clear persuasive response to a 2022 FINRA 8210 Letter Inquiry demonstrtating how our client did not violate FINRA rules, resulting in a simple warning letter which is not reportable on one's CRD record. 2) use of applications such as Whats App and We Chat so as to communicate with clients overseas resulting in communications which were not reviewed by the representative's Broker Dealer . We have responded to an 8210 Letter triggered by a termination and U5 filing resulting from the use of such apps and are awaiting the outcome. This trigger of the 8210 letter from the U5 filing highlights whey it is imperitive that a representative retain counsel as soon as they are terminated so that counsel may engage with their former employer BEFORE any U5 is filed which may then tigger a lenghty and costly FINRA 8210 letter. While we can not gurantee such engagement would avoid a 8210 letter, we are typically successful in influencing in what the employer places on any U5 so as to have the least impact on future employment and perhaps avoid the triggering of a FINRA 8210 investigation, as we are very familiar with what causes such triggers. 3) continued abuse of company expense accounts, food allowances, computer allowances, etc. as we have posted here previously. FINRA continues to issue 8210 letters related to terminations associated with unauthorized use of company expense accounts for personal expenses, whether for food, transportation or technology charges. We continue to represent numerous representatives who are terminated for the abuse of such accounts which much to the suprise of many representatives FINRA takes seriously and can be viewed as theft resulting in a Bar from the industry. 4) arrests, and/or convictions that had not been reported to FINRA as required. We continue to receive inquiries from reps regarding what needs to be reported and, just as important, what events do not need to be reported under FINRA rules. If you were recently terminated from a firm and want professional assistance in engaging with your former employer regarding your U5 so as to possibly avoid triggering a FINRA Enforcement Investigation and preserve your future employability, OR if you have received a FINRA Enforcement 8210 letter - DONT WAIT (as we may not be able to help you if you do wait) contact our offices for a FREE consultation as soon as possible.

1 Comment

6/26/2023 01:03:50 am

Thanks for sharing a very good informative blog I like it for more details please visit a website.

Reply

Leave a Reply. |

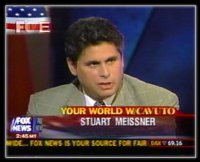

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed