We have received numerous calls from reps informing us that firms are cracking down on brokers abusing dinner, computer or transportation expense reimbursement accounts. Reps are being terminated and U5 forms are being marked resulting in more and more FINRA 8210 letters and year long FINRA Enforcement investigations. Brokers are being impacted by this purge of what in the past was viewed as a minor issue which in the past resulted in a simple warning. Now there are no more warnings, rather violators are being terminated. As reported by the Wall Street Journal, firms from Wells Fargo to Fidelity have been discharging brokers for violating expense policies regarding after hour meals. Others have been discharged for violating computer reimbursement policies by returning computers after being ordered and keeping the reimbursement instead of reporting the return. Other altered times on food receipts so as to meet firm time requirements for dinner reimbursement policies.

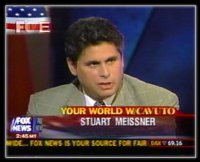

Many brokers don't realize the serious nature of such actions as on the surface they have nothing to do with clients and securities. However the impact on one's career can be devastating and not to be taken lightly. U5 forms mandate that firms report to FINRA if any termination involves "fraud or the wrongful taking of property" (Question 7F on Form U5). Such actions clearly renders the rep eligible for such being checked off. Once such is checked off on a Form U5 it automatically triggers a FINRA investigation and a FINRA 8210 Letter. FINRA Investigations tend to last over a year even if they do not seek sanctions, which impacts upon one's ability to be hired by another firm as they will inquire if there is a FINRA investigation, and no firm seeks to employ a broker who may be suspended or barred by FINRA. It is essential to retain a qualified FINRA Attorney early on, as soon as the rep is terminated, so that the attorney may be able to convince the firm not to check off Question 7F and if they do, to respond properly, so as to minimize the likelihood that FINRA pursues the investigation or seeks sanctions. These matters are not something to handle on one's own as too often reps dig a deep hole that the attorney they later retain cannot dig out from. Finally, too many reps incorrectly believe that if they resign voluntarily before they are terminated that they may avoid any issues. However, departing before being fired does not resolve any of the issues raised. One's U5 will still be marked as your departing during an investigation and when the investigation concludes your U5 will be amended. For further information or assistance Contact Stuart D. Meissner Esq. 866-764-3100. Note: New York based Meissner Associates is a nationally recognized employment law firm focused on the unique employment issues within the securities industry which is overseen by FINRA. The firm also represents SEC whistleblowers before the SEC, investors and securities professionals before FINRA arbitration panels and securities professionals in enforcement proceedings, as well as institutional and retail investors worldwide in recovering improper investment losses and protecting the employment rights of employees in the securities industry in FINRA arbitration and AAA Arbitration. Managing member Stuart Meissner is a former Assistant District Attorney in Manhattan and Assistant New York State Attorney General in the Investor Protection and Financial Crimes Units. Call Meissner Associates, FINRA Attorneys Nationwide Representation for FINRA Arbitrations NEW OFFICE ADDRESS: 1430 Broadway, Suite 1802 New York, N.Y. 10018 Along with five other convenient Manhattan Meeting Locations and five other cities across the US and London Attorney Advertising

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed