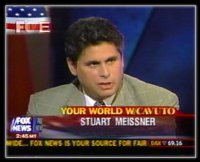

As an experienced nationwide FINRA Employment Arbitration law firm, we receive many calls from employees across the country, in the securities industry who have been terminated and wish to file a FINRA arbitration claim for wrongful termination. Often times the client asserts that they were wrongfully terminated due to something which they did not agree with or correctly believe the reasoning behind the discharge was improper or unfair for various reasons. While most brokers, financial advisors, registered representatives, financial consultants, etc who are employed in the securities industry are “at will” employees, meaning they are employed without an employment contract, such does not always prevent a legal action or a FINRA arbitration claim. While one may have been given forgivable promissory notes and have been provided front end bonuses, so as to try to keep them at the firm for many years, such typically make clear that the notes are not employment contracts and do not guarantee a length of employment. In fact, most notes mandate that the employee reimburse the firm for any portion of the upfront payments made which were not forgiven, which most representatives only learn, upon changing or leaving firms earlier than expected and then having to retain counsel to try to negotiate a reduction and/or a payment plan. While most employees are considered “at will” by the firm, which means, barring any discriminatory reason (age, race, gender, sexual preference, disability, whistleblower) which always allows for a wrongful discharge claim if such can be proven, the employee may be dismissed at the whim of their employer, just as the employee can leave at their whim. However, depending on the State you work in, the “at will” status may be limited in many ways, opening up the possibility of a discharged employee to file a wrongful discharge claim against the firm seeking back wages, future wages, potential punitive damages, costs and at times even attorney fees, all of which could save a career. Examples of situations where “at will” employees may in fact file a wrongful discharge claim based on the fact that the reason provided for their discharge was either false, the result of a faulty internal investigation, the result of incorrect assumptions, or even the result of minor violations of Codes of Conduct which should not result in termination, etc, run the gambit. Many of these situations overlap with faulty U-5 Filings and defamation of the employee, with possible FINRA Enforcement investigations then being triggered, possibly ruining a representative’s career literally over night. Adding insult to injury the firm then seeks reimbursement for the upfront funds provided to the rep, at a time when the rep is now unemployed with his/her record improperly tarnished and under FINRA investigation. This is the Nightmare Scenario that is happening more and more. STATEMENTS FROM SUPERVISOR – In 38 states, informal or formal statements from a supervisor or officer, without any disclaimer, can create an implied contract. For example a supervisor may state in writing (email or otherwise) or orally that as long as a representative does his job right he will always have his job. Such may have altered an “at will” employment to a just cause employment, as long as such belief by the employee would be reasonable, requiring the firm to then show just cause for the basis for any future discharge. EMPLOYEE HANDBOOK AND CODE OF CONDUCT STATEMENTS - similar to Statements, Handbooks and Code of Conducts can similarly create implied contracts in the same 38 states. At times the Employee Handbook or Code of Conduct may have statements referring to the manner in which the firm will treat its employees which could allow for a FINRA arbitration claim for wrongful discharge by a representative, not withstanding the “at will” nature of the relationship. For example, according to the recent successful wrongful discharge claim against Citigroup Global Markets, a June 2015 FINRA arbitration Panel held that its Code of Conduct contained a section called “Fair Treatment” which states in part “Citi is committed to dealing fairly with is clients, suppliers, competitors and employees.” Other Employee Handbooks may state that employees will only be terminated for “just cause.” Such clauses opened up Citigroup to wrongful discharge claims by employees, as a recent arbitration did in holding them liable for over $400,000 in damages for a wrongfully discharged Branch Manager for Citigroup related to what was a minor alleged breach of confidentiality which in itself was questionable as the client provided consent. Such provisions within the Code of Conduct allows for an analysis by an arbitration panel of exactly why a discharge took place, the lack of investigation conducted before the discharge, and even whether the discharge was appropriate compared to other greater transgressions by other Citigroup employees in the past and the lack of dismissal of those employees. However, a large caveat to such claims is that in 22 of the 38 states that allow for such implied contracts, if the employer includes a prominent and unambiguous disclaimer that anything stated within such Manuals or Code of Conduct does not create contractual obligations, then there would be no implied contractual obligations or alteration of the employment at will. PUBLIC POLICY EXCEPTIONS – All states with the exception of 8, recognize a public policy exception to the “at will” doctrine. Meaning in most states, an employer cannot discharge an employee if the reason for the discharge would be against public policy. Examples include, refusing to break the law or being discharged for filing a workman’s compensation claim. In the securities industry this may arise when an employee refuses to cooperate with their employer, with regard to providing false information to FINRA or other regulators conducting an audit or investigation. Such exception is very fact dependent and is impacted by the state one is employed in and as such an experienced FINRA employment arbitration attorney should be consulted. GOOD FAITH AND FAIR DEALING REQUIREMENT - Only 11 states, including California and Massachusetts, recognize this as implied in EVERY employment relationship. As a result every employer personnel decision is subject to a “just cause” standard and terminations made in bad faith or malice are prohibited.  SUMMARY At the end of the day there are several possible avenues that employees may explore if they believe they were wrongfully discharged or forced to leave (constructive discharge). In addition, to the above, such often also leads to the intentional infliction of emotional distress and possible defamation claims. As dismissals can have a lasting impact upon one’s career especially in the securities industry, it behooves all securities employees to consult with a qualified FINRA employment attorney, who is experienced in taking on large and small firms, about their particular situation as soon as possible. As many wronged employees have found with FINRA arbitration claims, "if you take on a Goliath, sometimes you in fact can and do win like a David". By: Stuart D. Meissner Esq. Managing Member Meissner Associates "when you are a David, that needs to take on a Goliath" 212-764-3100 or nationwide toll free 866-764-3100 Free Phone Consult office locations Attorney Advertising

6 Comments

2/28/2017 07:01:16 am

This was definitely one of my favorite blogs. Every post published did impress me.

Reply

8/17/2019 05:32:15 am

Than you for your comments. I appreciate it. Sorry for the delay.

Reply

8/17/2019 05:33:09 am

You are most welcome. Sorry for the delay in responding.

Reply

5/8/2019 12:03:23 pm

I really appreciate your work, and thank you so much for sharing this post

Reply

6/20/2019 11:13:15 pm

Thank you for pointing out that employees who are working in the securities industry are "at will" employees. My brother has been thinking of getting a job in securities. It's good to know what type of employment that is under.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorStuart D. Meissner Esq. is an experienced FINRA attorney who has practiced law for over 27 years, including as a FINRA Attorney, Securities Regulator and Prosecutor. Archives

September 2022

Categories

All

|

|

Disclaimer: Prior results cannot and do not guarantee or predict a similar outcome with respect to any future matter, including yours, in which a lawyer or law firm may be retained. The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for individual advice regarding your own situation.

|

RSS Feed

RSS Feed